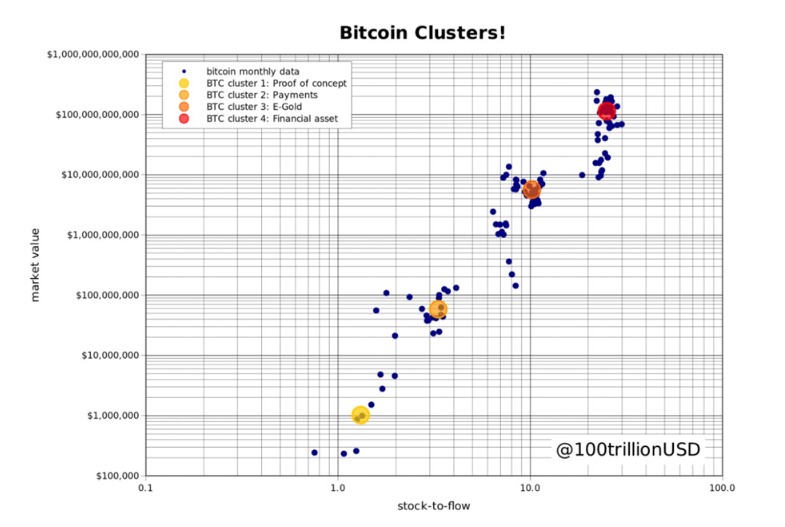

Bitcoin’s Price Fortune Teller – S2FX

In the last meeting, we focused on events and developments in the crypto market and precious metals, with an emphasis on Bitcoin and influences from the general market.

Here are some of the main topics we covered:

- Bitcoin and Michael Saylor: We discussed Saylor’s influence, who is considered one of the leading investors in Bitcoin, and the criticism from market veterans. Saylor has faced complications after speaking about the “safe way” to hold Bitcoin, which he claims would be through traditional financial giants.

These discussions highlight the dynamics and diversity of the community and the entire financial world.

?Stable coins VS Unstable banks

The last weekend showed how much can happen in a small blink of the market. Where does it all start? Or what is even a stablecoin in an unstable period? The coin flipped?

First off, I have no intention of portraying myself as someone happy with the shortcomings or downfall of others – not even some “whistleblower” saying “it won’t happen to me.” Keep the question echoing in a small corner of your mind when asked if this happened within 48 hours to leading countries and banks, what could similarly happen?

In my eyes, it all starts with the existing system and traditional banking.

Digital wallets – from then until today

A digital wallet is the safe way to store our digital assets.

Opening a wallet is a necessary action to maintain a high level of security and proper storage of our digital assets.

In this article, we will review together the different types of wallets and learn a little about their history up to the rapid development and the included uses.

We will discover the advantages of each of them. We will find out what dangers await us and what we should be careful of.

The Practical Guide to Buying Digital Currencies

In order to purchase digital currencies, there will be several preliminary steps we will need to take in order for the process to be smooth and simple.

First, we will need to have a digital wallet and make sure we have somewhere to receive the coins we will purchase.

Most wallets support the leading currencies, and when you reach situations of purchasing smaller tokens and coins, you may encounter different types of wallets in order to carry out the next step.

But for now, let’s refer to the classic case of buying bitcoin.